Articles

Customer care and you may Affiliate ExperienceResponsive customer care and a person-amicable site try important to own a smooth betting feel. I measure the availability and you will overall performance of the gambling enterprise’s customer service team, checking to own several get in touch with options including live cam, email address, and you can cellular telephone help. Cellular gambling enterprises are preferred recently because of the development of HTML5 tech.

In which must i discover a hundred no deposit incentive rules?

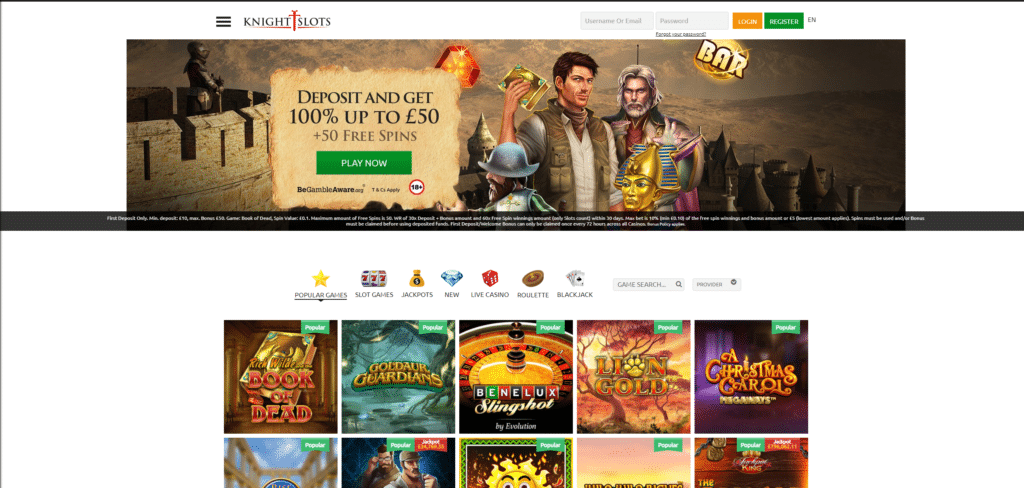

That’s as to why of a lot players choose $10 minimal deposit casinos, where the laws are usually simpler to fulfill plus the incentives make you more to experience which have. Make sure to find systems which have a strong track record, self-confident pro ratings, and correct certification. Speak about message boards, remark internet sites, and you can player reviews to understand the fresh reputation for the newest local casino you happen to be given ahead of to play at minimum deposit gambling enterprises. Imagine issues including games diversity, customer care responsiveness, and you may prompt earnings. Minimum deposit gambling enterprises is gambling on line platforms you to definitely let players begin doing offers which have a relatively reduced 1st put number.

Greatest $step one lowest deposit gambling enterprises within the October

Minimum put casinos try gambling enterprises that allow you to play for real cash by the placing a minimal amount of money into your account. That is a famous selection for participants whom don’t need to put considerable amounts in the beginning and you may just who might would like to try out the games prior to making a large economic partnership. If your monthly homeloan payment has a price placed in escrow (make the proper care of a third party) for real estate fees, you do not be able to subtract the quantity placed inside escrow. You might deduct only the home taxation that the third group in reality paid back to the taxing expert. Should your alternative party doesn’t notify you of one’s number of a property tax you to is taken care of you, contact the 3rd group or even the taxing authority to find the proper amount to exhibit on your own return. The customer and also the supplier need to divide the actual home taxation with regards to the quantity of weeks in the property taxation 12 months (the period to which the brand new income tax is actually implemented applies) that each owned the house or property.

GamblingRiot.com is the one-stop origin for all gambling advice. Gold Pine Gambling establishment open to have team during 2009, so it’s other senior United states gambling enterprise for this list. This site is named a house to own ports playing, which have much emphasis on ports within their advertisements and you may online game library.

If you prepare your individual go back, log off this area empty. If the another person prepares your go back and you can doesn’t charge you, that https://vogueplay.com/in/kerching-online-casino-review/ individual shouldn’t indication your get back. The brand new preparer need make you a duplicate of one’s come back in the addition to the content submitted to the Irs. You should handwrite your own trademark in your return for individuals who file it written down.

What is the compound interest algorithm, which have a good example?

Sweepstakes casino get no limits for the online game certain to a incentive. Real money web based casinos outline particular game you can’t enjoy whenever by using the money earned from a casino bonus. Alive broker and jackpot position video game are celebrated preferred examples, but read the offer’s small print to be sure.

Tax Dining tables

If your Irs figures your income tax therefore paid off too much, you are going to discovered a reimbursement. For many who didn’t pay sufficient, you are going to discover a statement on the harmony. To avoid attention or even the penalty to possess later commission, you should afford the bill in this 1 month of the go out of one’s costs or by the due date for the go back, any kind of are later. Once you figure your income tax and you can any AMT (discussed later on), determine if you are qualified to receive one taxation credits. Eligibility advice for those taxation credits is discussed in other publications and your form guidelines. The following products are some of the credits you happen to be in a position to subtract from the taxation and reveals where you are able to discover more information on for each and every credit.

A haphazard Person Delivered Me Money on Cash Software: What’s Second?

You can find the fresh notice from the weekly Inner Cash Bulletin (IRB) during the Internal revenue service.gov/IRB, otherwise visit Internal revenue service.gov and go into “Unique For every Diem Rates” in the research container. As the a personal-working individual, your effectively membership by the reporting their real expenses. You need to stick to the recordkeeping legislation inside chapter 5. Sufficient bookkeeping and reasonable time period was mentioned before inside the so it part. Various other performing musician, Ari, and resides in Austin and you can works well with a similar company while the inside Analogy step one.

Such as, you can receive a great $100 added bonus wager to possess it comes a pal who subscribes to own an account and you may dumps at the least $50. This type of sales are especially common just after on the internet wagering releases, when a good sportsbook is attempting to gain market share. We’ve discussed an educated incentives offered at courtroom on the web sportsbooks, but these product sales are only the end of your iceberg. You’ll find a lot of other offers readily available during the legal sporting events gambling, for instance the following the sportsbook promos. Regarding the earliest downside, it’s best whenever on line sportsbooks give individual bonus bet credit ($twenty-five for every, including) rather than a lump sum. A bonus borrowing lets you choice in the shorter increments (age.grams., $a hundred dispersed over cuatro bets) while offering a lot more independence.

550, section step one and/or Plan B (Setting 1040) guidelines. Fundamentally, when someone get interest as the a nominee for you, see your face need give you a questionnaire 1099-INT appearing the attention received on your behalf. Even if you do not found a form 1099-INT, you must still declaration all desire earnings. For example, you can also found distributive shares of interest out of partnerships or S organizations. So it focus are advertised for your requirements to the Plan K-step one (Mode 1065) or Agenda K-1 (Form 1120-S). Or even give your own TIN to the payer of great interest, you may need to shell out a punishment.